Disposable Syringes Market Forecast and Outlook 2025 to 2035

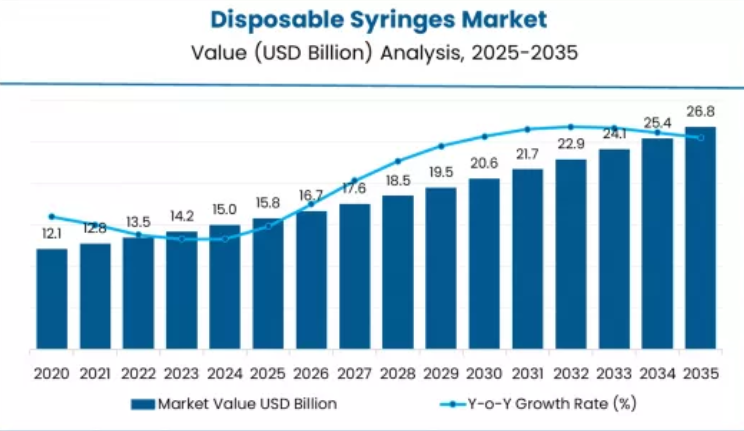

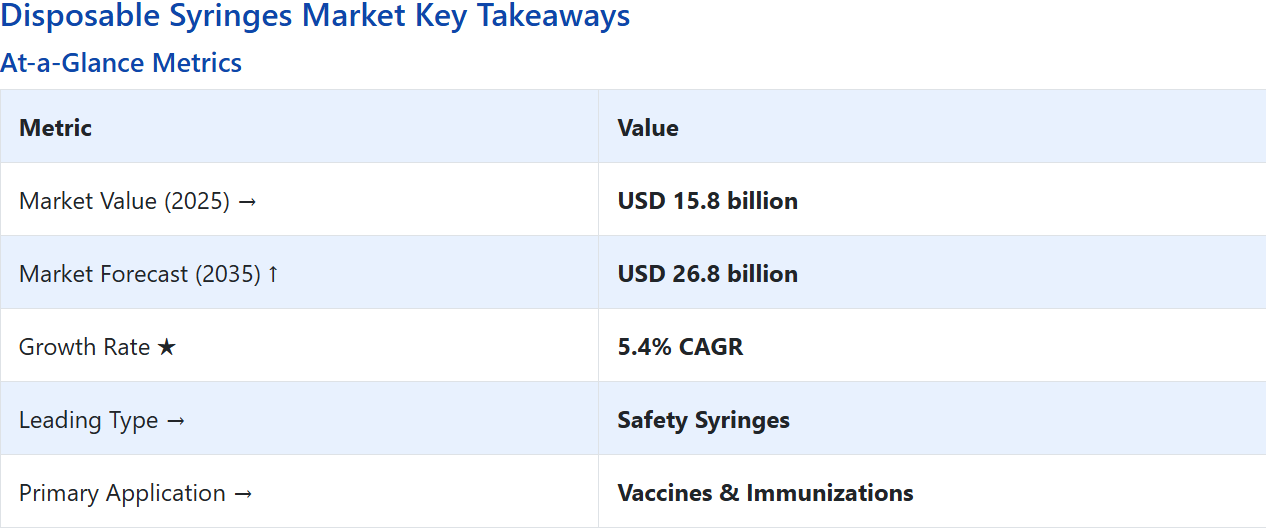

The global disposable syringes market is set to grow from USD 15.8 billion in 2025 to USD 26.8 billion by 2035, adding USD 11.0 billion in new revenue and advancing at a CAGR of 5.4%. Growth is driven by escalating demand for infection prevention solutions, expanding immunization infrastructure across regulated markets, and accelerating needlestick injury prevention requirements among healthcare organizations seeking single-use safety capabilities.

Quick Stats for Disposable Syringes Market

Disposable Syringes Market Value (2025): USD 15.8 billion

Disposable Syringes Market Forecast Value (2035): USD 26.8 billion

Disposable Syringes Market Forecast CAGR: 5.4%

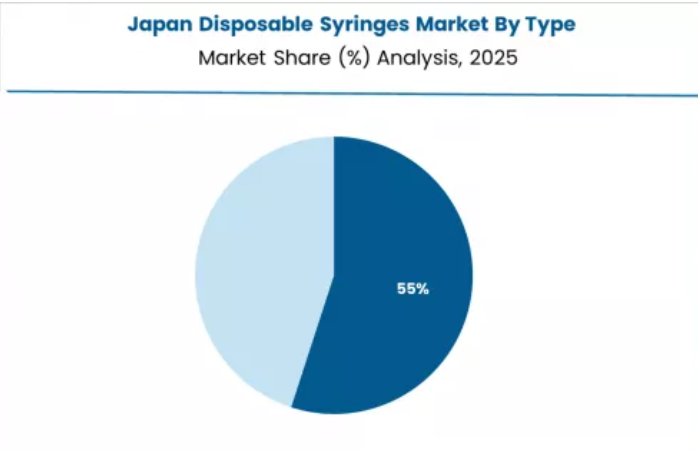

Leading Type in Disposable Syringes Market: Safety Syringes (55.0%)

Key Growth Regions in Disposable Syringes Market: Asia Pacific, North America, and Europe

Top Players in Disposable Syringes Market: Nipro, B. Braun SE, BD, Terumo Europe,Smith Medical,KDL,fisher scientific,Cardinal,Faustum

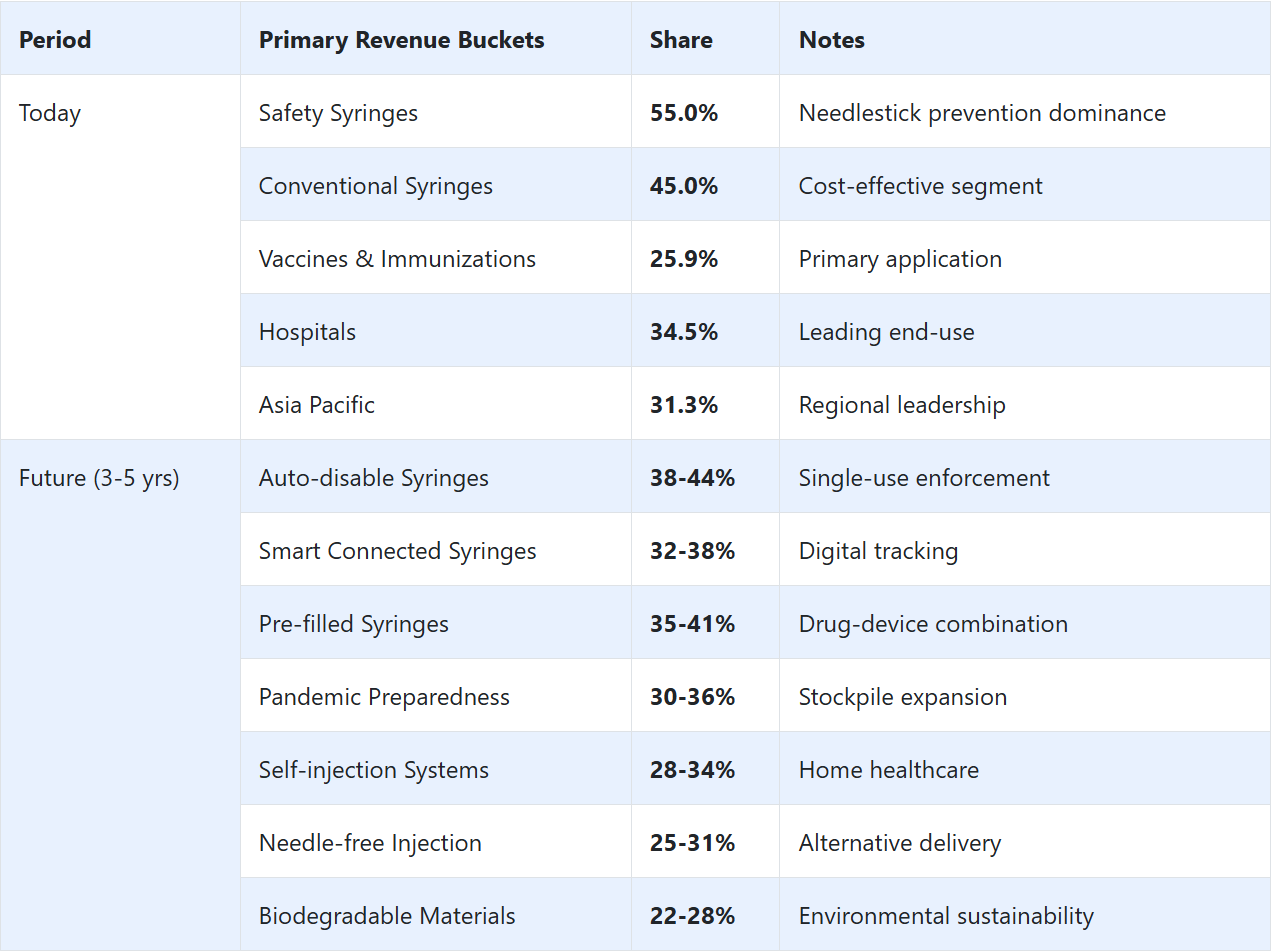

Where revenue comes from - Now Vs Next (Industry-level view)

Disposable syringe technologies are increasingly recognized as essential tools for medical administration practitioners, offering precise sterility assurance capabilities, cross-contamination prevention, and comprehensive patient safety characteristics compared to traditional reusable syringe approaches. Safety Syringes dominate the market with 55.0% share, favored in hospital and healthcare environments for their established needlestick protection properties, providing automatic retraction mechanisms, injury prevention capabilities, and regulatory compliance across diverse clinical applications and healthcare demographics.

Vaccines & Immunizations remain fundamental in application protocols where mass vaccination campaigns and immunization program operations match public health requirements and disease prevention confidence standards. Hospitals are advancing among end-use categories as specialized healthcare facility networks expand and infection control infrastructure increases accessibility in treatment-convenient locations with stringent safety structures.

Geographic concentration demonstrates dynamic growth patterns with India and China leading expansion, supported by rising healthcare infrastructure capacity, vaccination program consciousness expansion among population demographics, and medical device manufacturing establishment programs in production centers.

USA, Germany, Japan, Indonesia, and Brazil demonstrate robust development through established healthcare delivery ecosystems, regulatory framework maturity for medical devices, and standardized acceptance of single-use procedures. Competitive advantage is consolidating around safety feature profiles, needlestick prevention documentation, injection comfort compatibility, and integrated infection control portfolios rather than standalone syringe formulations alone.

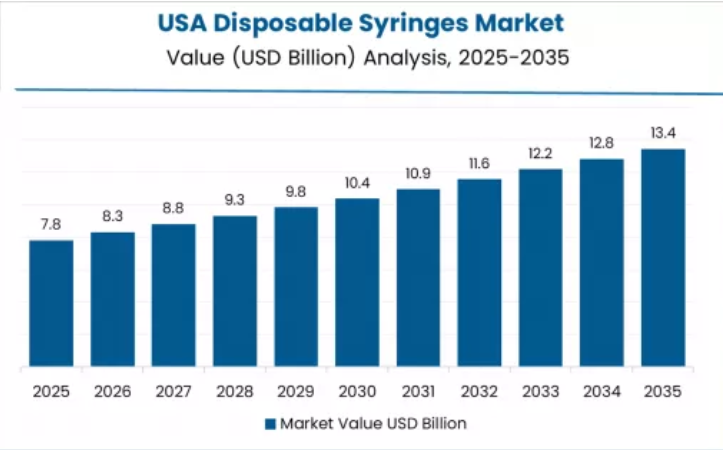

The first half of the decade will witness the market climbing from USD 15.8 billion to approximately USD 20.2 billion, adding USD 4.4 billion in value, which constitutes 40.0% of the total forecast growth period. This phase will be characterized by the continued dominance of safety syringe methodologies in hospital settings, combined with accelerating adoption of retractable safety technologies in vaccination applications where injury prevention and regulatory compliance create favorable healthcare outcomes.

The latter half will witness sustained expansion from USD 20.2 billion to USD 26.8 billion, representing an addition of USD 6.6 billion or 60.0% of the decade's growth, defined by broadening acceptance of auto-disable syringe protocols and integration of smart syringe platforms across mainstream immunization facilities.

The market demonstrates exceptional fundamentals with Safety Syringes capturing a commanding 55.0% share through superior needlestick protection characteristics, established healthcare worker safety advantages, and proven injury prevention profiles across medical administration applications. Vaccines & Immunizations drives primary application demand at 25.9% share, supported by established mass vaccination infrastructure and immunization program requirements that maintain public health protection across diverse population segments.

Geographic concentration remains anchored in Asia Pacific and North America with emerging market leadership through manufacturing capacity expansion and healthcare access development, while developed markets show accelerated adoption rates driven by safety regulation demographics and infection prevention procedure preferences.

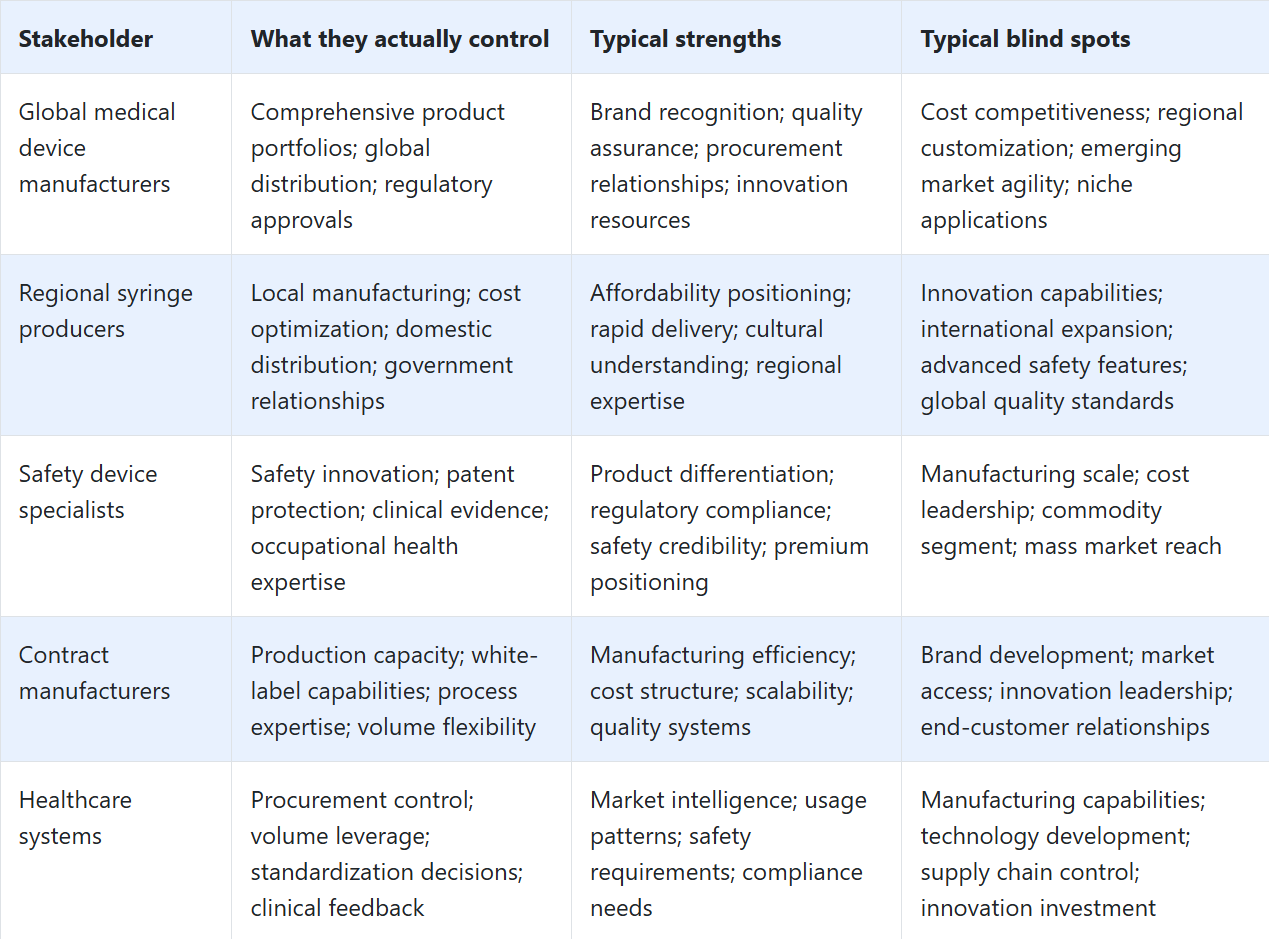

Imperatives for Stakeholders in Disposable Syringes Market

Design for safety and compliance, not just injection delivery

Offer complete injection safety solutions: advanced retraction mechanisms + needlestick prevention features + infection control documentation + disposal system integration + training support platforms.

Preconfigured safety packages: hospital safety specifications, vaccination campaign configurations, diabetes management programs, and combination administration protocols for diverse clinical requirements.

Regulatory readiness for medical device applications

Comprehensive ISO 13485 documentation, FDA/CE mark compliance systems, and quality infrastructure (biocompatibility testing, sterility assurance, needlestick safety validation protocols).

Affordability-by-design approach

Cost-optimized safety portfolios, flexible procurement models, volume discount programs, and transparent total cost-of-ownership documentation.

Healthcare provider training-focused market penetration

Established safety device workshops + comprehensive certification programs (proper technique, disposal procedures, injury prevention); direct clinician engagement for relationship development and product confidence building.

Segmental Analysis

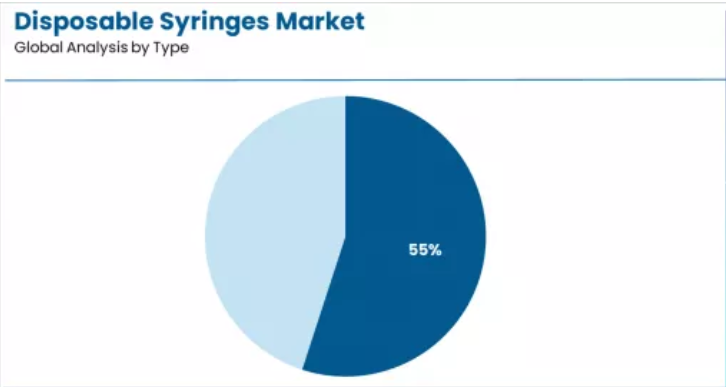

Primary Classification: The market segments by type into Safety Syringes and Conventional Syringes, representing the evolution from basic injection delivery toward sophisticated safety-engineered devices with needlestick prevention capabilities, comprehensive injury protection characteristics, and integrated compliance features.

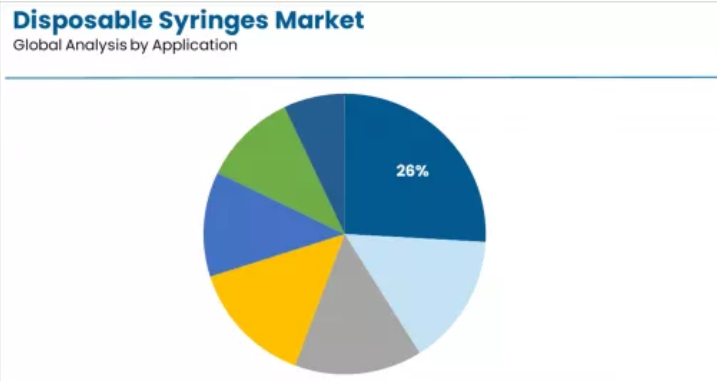

Secondary Classification: Application segmentation divides the market into Vaccines & Immunizations (25.9%), Oncology, Diabetes, Rheumatoid Arthritis, Autoimmune diseases, Anaphylaxis, and Others, reflecting distinct therapeutic objectives for mass vaccination delivery and disease prevention versus chronic disease management implementation and emergency medication administration.

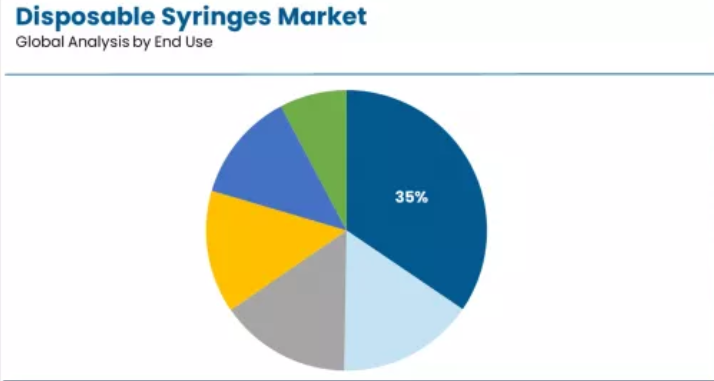

Tertiary Classification: End-use segmentation shows Hospitals commanding 34.5% position, followed by Diagnostic Laboratories, Blood Banks, Pharmaceutical Industry, Veterinary purposes, and Others at 20.0%, demonstrating varied clinical setting levels and usage volume requirement concentrations.

The segmentation structure reveals disposable syringe evolution from basic needle-and-barrel technology toward comprehensive safety-engineered platforms with enhanced injury prevention characteristics and multi-dimensional infection control compliance capabilities, while type diversity spans from conventional low-cost syringes to sophisticated safety devices requiring specialized healthcare provider training.

Which Disposable Syringe Type is the Most Preferred?

Market Position: Safety syringes command the leading position in the disposable syringes market with a 55.0% share through superior needlestick injury prevention characteristics, including established retraction mechanism presence, extensive healthcare worker protection capabilities, and standardized safety compliance pathways that enable healthcare facilities to achieve predictable injury reduction outcomes across varied clinical procedures and diverse healthcare demographics.

Value Drivers: The segment benefits from protection advantages through automatic safety activation, needlestick injury elimination without additional steps, and established regulatory compliance frameworks without requiring extensive protocol modifications. Advanced safety syringe technology enables retractable needle optimization, passive safety activation customization, and shielding mechanism variation, where activation reliability and user acceptance represent critical safety requirements. Retractable safety syringes hold significant share within the safety segment, appealing to hospitals seeking foolproof protection capabilities for comprehensive healthcare worker safety.

Competitive Advantages: Safety Syringe solutions differentiate through proven injury prevention profiles, regulatory compliance advantages, and integration with established occupational safety protocols that enhance healthcare worker confidence while maintaining compliant infection control outcomes for diverse clinical applications.

Key market characteristics:

Advanced safety features with automatic needle retraction and permanent disability for needlestick injury prevention

Superior regulatory compliance, enabling OSHA requirement satisfaction and WHO prequalification for healthcare applications

Comprehensive user acceptance, including intuitive activation and minimal technique modification for clinical adoption

Why do Conventional Syringes Represent a Cost-sensitive Segment?

Conventional syringes maintain specialized market position at 45.0% through affordability characteristics and established clinical familiarity. These syringes appeal to cost-conscious facilities and resource-limited settings seeking basic injection delivery with proven performance reliability, offering simple design and widespread availability through traditional syringe systems. Market adoption is driven by emerging market applications, emphasizing complete injection delivery evaluation and budget constraint accommodation through economical device mechanisms.

By Application, Which Segment Dominates in the Disposable Syringes Market?

Market Context: Vaccines & immunization demonstrate application leadership in the disposable syringes market with a 25.9% share due to widespread immunization program prevalence and established focus on mass vaccination campaigns, routine childhood immunization schedules, and pandemic preparedness that maximizes population protection while maintaining consistent public health standards.

Appeal Factors: Public health officials and healthcare providers prioritize vaccination applications for high-volume administration requirements, sterility assurance critical importance, and integration with established immunization protocols that enables coordinated delivery experiences across multiple vaccine types. The segment benefits from substantial WHO prequalification standardization and UNICEF procurement documentation that emphasizes auto-disable syringe approaches for vaccine administration across diverse global demographics. COVID-19 vaccination campaigns capture significant volume within the vaccines segment, demonstrating program preference for safety-engineered formats.

Growth Drivers: Routine immunization program expansion incorporates disposable syringes as essential delivery protocols for disease prevention, while pandemic preparedness stockpiling increases procurement volumes that meet emergency response requirements and ensures rapid deployment capabilities.

What drives Oncology Application Adoption in Chemotherapy Administration?

Oncology applications capture substantial share at 15.0% through comprehensive requirements in chemotherapy frameworks, hazardous drug handling capabilities, and integrated safety protocols. These applications demand sophisticated safety features capable of achieving cytotoxic drug protection while providing precise dosing accuracy and healthcare worker exposure prevention, appealing to oncology departments and infusion centers seeking evidence-based chemotherapy administration advantages beyond general injection approaches.

What Establishes Hospitals' Market Leadership in Disposable Syringes End-use?

Market Context: Hospitals establish market leadership in the disposable syringes sector with a 34.5% share due to comprehensive clinical volume requirements and sustained focus on inpatient care delivery, outpatient procedure administration, and infection control protocols that maximizes patient safety while maintaining appropriate healthcare-associated infection prevention standards.

Appeal Factors: Hospital administrators and clinical staff prioritize hospital settings for high-volume injection requirements, comprehensive safety protocol implementation, and integration with established medication administration workflows that enables coordinated care experiences across multiple medical departments. The sector benefits from substantial infection prevention infrastructure maturity and Joint Commission safety campaigns that emphasize safety-engineered device delivery for critical clinical care applications.

Growth Drivers: Surgical procedure expansion incorporates safety syringes as standard medication administration protocols for perioperative care, while chronic disease management growth increases injection frequency that meets therapeutic requirements and ensures patient outcome optimization capabilities.

End-use dynamics include:

Strong growth in ambulatory surgery centers requiring safety devices and regulatory compliance arrangements

Increasing adoption in emergency departments for rapid medication administration and needlestick protection positioning

Rising integration with pharmacy automation for pre-filled medication and dispensing efficiency enhancement

What are the Drivers, Restraints, and Key Trends of the Disposable Syringes Market?

Analysis of the Disposable Syringes Market by Key Countries

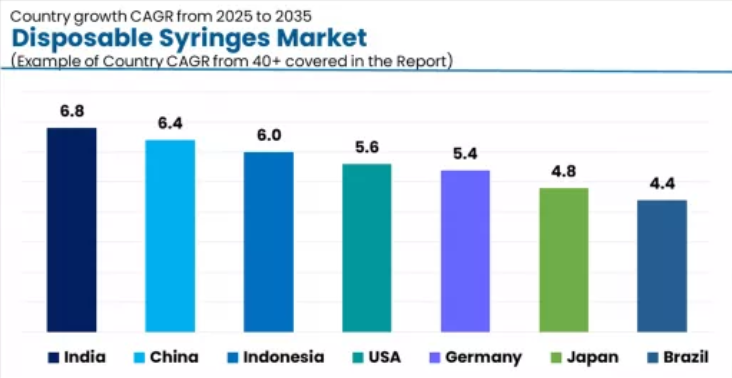

The disposable syringes market demonstrates robust regional growth dynamics with emerging leaders including India (6.8% CAGR) and China (6.4% CAGR) driving expansion through manufacturing capacity programs and immunization infrastructure development. Strong performers encompass Indonesia (6.0% CAGR), the USA (5.6% CAGR), and Germany (5.4% CAGR), benefiting from established healthcare delivery infrastructure and vaccination program demographics. Developed markets feature Japan (4.8% CAGR) and Brazil (4.4% CAGR), where infection prevention normalization and healthcare access support consistent growth patterns.

Regional synthesis reveals Asian markets leading adoption through comprehensive production capacity positioning and population health investment expansion, while Western countries demonstrate measured growth potential supported by safety regulation preferences and quality assurance influence. Global markets show solid development driven by immunization program culture integration and advanced manufacturing infrastructure.

India Drives Manufacturing Capacity Leadership

India establishes manufacturing capacity leadership through progressive medical device production expansion and comprehensive export-oriented infrastructure programs, positioning disposable syringe technologies as essential healthcare solutions in domestic hospitals and emerging international markets. The country's 6.8% growth rate reflects rising production capacity levels supporting global supply and growing domestic healthcare access that encourages the deployment of affordable safety solutions in diverse clinical settings.

Growth concentrates in major manufacturing hubs, including Maharashtra, Tamil Nadu, and Karnataka, where production facilities showcase increasing capacity for international quality standard adoption that appeal to cost-conscious buyers demanding validated sterility and competitive pricing outcomes.

Indian manufacturers are developing standardized syringe protocols that combine automated production technology with skilled workforce partnerships, including WHO prequalification expansion and UNICEF supply growth. Distribution channels through government procurement systems and international export networks expand market access, while quality certification initiatives support adoption across diverse country types and healthcare system specialization levels.

China Emerges as Production Volume Leader

In Jiangsu, Zhejiang, and Guangdong regions, medical device manufacturers and healthcare supply companies are adopting advanced syringe production technologies as essential manufacturing tools for domestic healthcare operations, driven by increasing population health alignment with universal coverage goals and elevation of medical device quality expectations that emphasize the importance of validated sterility assurance.

The market holds a 6.4% growth rate, supported by national healthcare reform programs and medical device industry investment that promote domestic production for self-sufficiency applications. Chinese manufacturers are favoring automated production platforms that provide comprehensive volume capabilities and cost-competitive positioning, particularly appealing in production clusters where scale efficiency and export competitiveness represent critical business factors.

Market expansion benefits from substantial medical device park investment and supply chain integration development that enable widespread adoption of evidence-based manufacturing methodologies for diverse syringe applications. Industry adoption follows patterns established in pharmaceutical manufacturing excellence, where production scale advantages and quality system documentation drive buyer confidence and regulatory approval achievement.

USA Shows Safety Regulation Leadership

USA establishes safety regulation leadership through comprehensive OSHA framework and established FDA compliance ecosystem, integrating disposable syringe solutions across hospital systems, outpatient facilities, and retail pharmacies. The country's 5.6% growth rate reflects established medical device regulatory maturity and sophisticated healthcare worker safety commitment levels that support widespread deployment of validated safety-engineered solutions in clinical and ambulatory applications.

Growth concentrates in established healthcare regions, including Northeast, Southeast, and West Coast, where healthcare systems showcase advanced occupational safety adoption that appeals to compliance-focused organizations seeking predictable injury prevention outcomes and comprehensive liability documentation.

American healthcare providers leverage established group purchasing relationships and comprehensive safety protocol frameworks, including needlestick injury reporting systems and post-exposure prophylaxis programs that create healthcare worker confidence and institutional assurance. The market benefits from substantial home healthcare expansion and biologics growth that encourage premium safety syringe purchases while supporting continuous innovation investments and auto-injector development funding.

Germany Demonstrates Quality Assurance Excellence

Germany's sophisticated healthcare market demonstrates established disposable syringe integration with documented quality emphasis in manufacturing standards and regulatory compliance execution through specialized hospital systems and established medical supply organizations. The country maintains a 5.4% growth rate, leveraging stringent medical device regulations with evidence-based procurement frameworks.

Premium healthcare regions, including Bavaria, North Rhine-Westphalia, and Baden-Württemberg, showcase quality-driven approaches where disposable syringes integrate with established infection control cultures and thorough documentation practices to optimize patient safety and ensure appropriate medical device performance.

German healthcare facilities prioritize ISO certification requirements and comprehensive quality validation in syringe procurement, creating demand for certified solutions with extensive testing characteristics, including biocompatibility verification, sterility validation, and comprehensive performance documentation. The market benefits from established hospital quality management segments and medical device expertise that provide differentiation opportunities and compliance with strict German medical device regulations.

Indonesia Shows Healthcare Access Expansion

Indonesia's developing healthcare market demonstrates progressive disposable syringe adoption with documented immunization program emphasis in vaccine delivery implementation and public health protocol execution through government healthcare centers and established vaccination campaign organizations. The country maintains a 6.0% growth rate, leveraging national immunization expansion with population coverage goals and disease prevention-focused healthcare investment.

Major population centers, including Java, Sumatra, and Sulawesi, showcase vaccination program approaches where disposable syringes integrate with established public health cultures and comprehensive disease prevention systems to optimize immunization rates and maintain WHO-recommended coverage under Ministry of Health supervision.

Indonesian health authorities prioritize affordability and comprehensive WHO prequalification in syringe procurement, creating demand for cost-effective solutions with extensive safety characteristics, including auto-disable features, single-use validation, and comprehensive sterility assurance. The market benefits from established GAVI alliance support sectors and international development programs that provide funding opportunities and maintain alignment with national immunization targets.

Japan Demonstrates Aging Population Healthcare

Japan's mature healthcare market demonstrates established disposable syringe integration with documented quality focus in clinical precision and infection control excellence through specialized hospitals and established healthcare facilities.

The country maintains a 4.8% growth rate, leveraging super-aged society demographics with chronic disease prevalence and home healthcare frameworks. Premium healthcare regions, including Tokyo, Osaka, and Nagoya, showcase quality assurance approaches where disposable syringes integrate with established medical cultures and meticulous safety systems to optimize injection accuracy and ensure appropriate clinical outcomes.

Japanese healthcare providers prioritize manufacturing quality and comprehensive performance validation in syringe selection, creating demand for precision-engineered solutions with extensive quality characteristics, including dimensional accuracy, smooth plunger operation, and comprehensive sterility testing. The market benefits from established diabetes management segments and self-injection device adoption culture that provide quality positioning opportunities and comply with Japanese pharmaceutical affairs regulations.

Brazil Shows Public Immunization Leadership

Brazil's developing healthcare market demonstrates progressive disposable syringe adoption with documented public health emphasis in national immunization program execution and universal healthcare delivery through Sistema Único de Saúde facilities and established primary care networks.

The country maintains a 4.4% growth rate, leveraging comprehensive immunization infrastructure with government procurement systems and population health-focused vaccination investment. Major healthcare regions, including São Paulo, Rio de Janeiro, and Brasília, showcase public program approaches where disposable syringes integrate with established vaccination cultures and comprehensive health surveillance systems to optimize immunization coverage and maintain disease elimination targets under Ministry of Health guidelines.

Brazilian health authorities prioritize public procurement value and comprehensive safety features in syringe acquisition, creating demand for cost-effective safety solutions with extensive compliance characteristics, including WHO prequalification, auto-disable validation, and comprehensive cold chain compatibility. The market benefits from established routine immunization sectors and pandemic response preparedness that provide volume opportunities and maintain alignment with national health priorities.

Europe Market Split by Country

The European disposable syringes market is projected to grow from USD 3.8 billion in 2025 to USD 6.1 billion by 2035, registering a CAGR of 4.9% over the forecast period. Germany is expected to maintain its leadership position with a 26.8% market share in 2025, declining slightly to 25.4% by 2035, supported by its advanced medical device manufacturing infrastructure and major healthcare systems including university hospitals.

France follows with a 18.9% share in 2025, projected to reach 19.2% by 2035, driven by comprehensive public healthcare programs and Paris medical center concentration. The UK holds a 17.3% share in 2025, expected to decrease to 16.8% by 2035 due to NHS budget pressures. Italy commands a 14.2% share, while Spain accounts for 11.6% in 2025.

The rest of Europe region is anticipated to gain momentum, expanding its collective share from 11.2% to 12.4% by 2035, attributed to increasing safety device adoption in Nordic countries and emerging Eastern European healthcare facilities implementing infection prevention programs.

Competitive Landscape of the Disposable Syringes Market

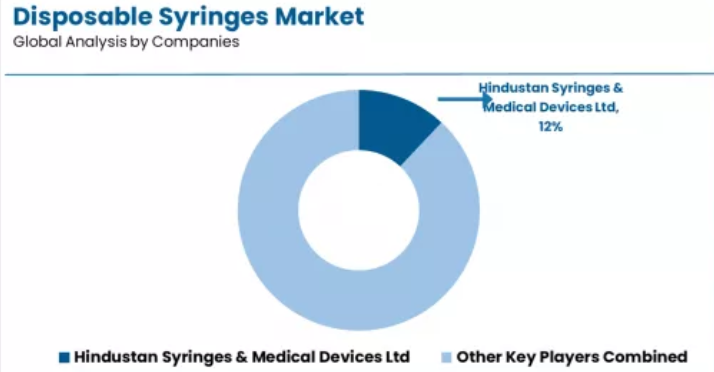

The disposable syringes market exhibits a moderately consolidated competitive structure with approximately 150-200 active players operating across global medical device manufacturing networks and regional supply distribution portfolios. Hindustan Syringes & Medical Devices Ltd maintains market leadership at a 12.0% share, reflecting strong production volume positioning across diverse healthcare segments with sophisticated export strategies.

This competitive landscape demonstrates the maturation of disposable syringe technology, where established players leverage manufacturing scale advantages, extensive regulatory approval portfolios, and healthcare system relationships to maintain dominant positions, while emerging safety innovation developers and regional manufacturers create niche opportunities through specialized device offerings and competitive pricing strategies.

Market leadership is maintained through several critical competitive advantages extending beyond production capabilities and device portfolios. Global distribution networks enable leading players to navigate diverse regulatory requirements and access varied healthcare segments including hospitals, immunization programs, and home healthcare markets.

Manufacturing expertise and quality assurance program availability represent crucial differentiators in disposable syringe categories, where decades of medical device production experience, ISO certification protocols, and regulatory compliance frameworks create procurement preference among quality-focused healthcare systems. Production efficiency in automated manufacturing facilities, sterility validation operations, and supply chain raw material sourcing separate major manufacturers from smaller competitors, while comprehensive regulatory documentation addressing biocompatibility testing, clinical evaluation, and post-market surveillance strengthen market position and buyer confidence.

The market demonstrates emerging differentiation opportunities in smart syringe categories and biodegradable material technologies, where traditional plastic syringe methodologies face competition from innovation-focused entrants offering sustainability advantages. However, significant competitive advantages persist in established safety syringe categories through comprehensive WHO prequalification portfolios and procurement relationship depth. Premium positioning strategies with connected device integration and dose tracking capabilities command margin premiums through superior medication adherence monitoring and data analytics.

Specialized product portfolios combining multiple safety mechanisms with application-specific designs create comprehensive positioning that justifies higher price points beyond commodity syringe competition. Integrated solution offerings emphasizing complementary sharps disposal systems, unified training platforms, and cross-application safety programs generate healthcare facility loyalty and procurement preferences beyond transactional device purchases.

Key Players in the Disposable Syringes Market:

BD

Nipro

B. Braun SE

Fisher scientific

Terumo Europe

Cardinal Health

Smith Medical

KDL

SMB Corporation of India

TKMD

Faustum

Disposable Syringes Market by Segments

Type :

Conventional Syringes

Safety Syringes

Retractable Safety Syringes

Non-retractable Safety Syringes

Application :

Vaccines and immunizations

Anaphylaxis

Rheumatoid Arthritis

Diabetes

Autoimmune diseases

Oncology

Others

End Use :

Hospital

Diagnostic Laboratories

Blood Banks

Pharmaceutical Industry

Veterinary purposes

Others

Region :

North America

USA

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Rest of Europe

Asia Pacific

India

China

Indonesia

Japan

South Korea

ASEAN

Australia & New Zealand

Rest of Asia Pacific

Latin America

Brazil

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of Middle East & Africa

RI 509,5/FTHE CLOUD 111TUNGCHAU STREET TAI KOK TSUIKOWLOON HONG KONG